Federal payroll calculator 2023

Federal Direct Student Loans are long-term low-interest loans awarded to students by SUNY ESF which are funded directly through the federal government. And while specific allocations of the raise have not been.

Who Bears The Burden Of Federal Excise Taxes Tax Policy Center

1300 per hour.

. Impact on trust funds likely minimal Social Security is funded by a payroll tax of 124 percent on eligible wages employees and employers each pay 62 percent. Enter your filing status income deductions and credits and we will estimate your total taxes. If your EOD falls between July 1 and December 31 you will receive your increment in July 2022.

Florida employers are responsible for withholding and paying the same federal payroll taxes as employers in the 49 other states. PenSoft Payroll is the best value in payroll. Florida Hourly Paycheck and Payroll Calculator.

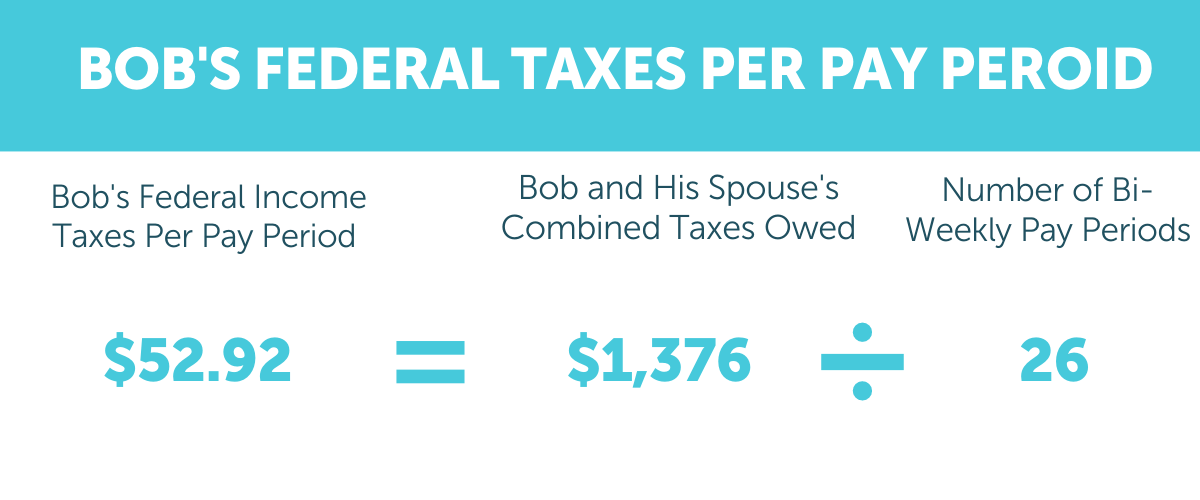

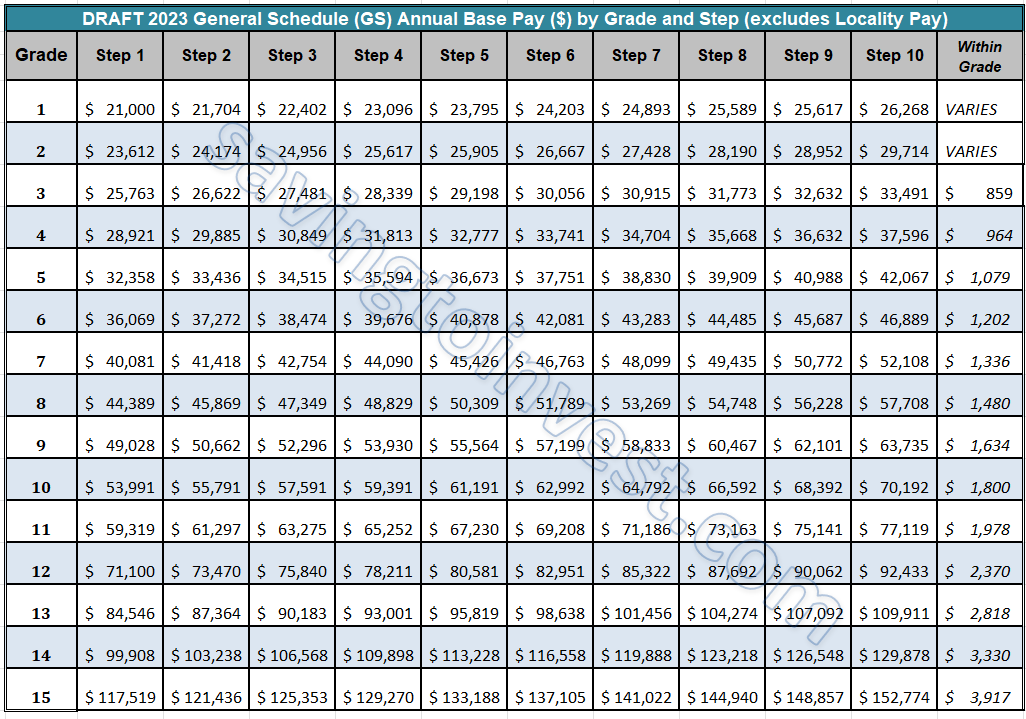

Federal calculations will now use the official federal tax brackets and deductions and state calculations will use the most recent brackets available. Federal employees can expect a pay increase in 2023 that is double the amount of any annual increase in over 10 years. This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA.

1040 Tax Estimation Calculator for 2022 Taxes. The 21 st Century Community Learning Centers CCLC Program is authorized under Title IV Part B of the Elementary and Secondary Education Act ESEA of 1965 as amended by the Every Student Succeeds Act ESSA of 2015. The Senate passed an appropriations bill which silently endorses the Presidents recommendation for federal employees to receive a 46 pay increase next year.

We also offer a 2020 version. It had originally closed applications on August 8 2020 but. Use this simplified payroll deductions calculator to help you determine your net paycheck.

In Fiscal Year 2023 in keeping with the usual practice contractual employees may receive an increment at the employing agencys discretion. Some taxes are paid by the employee some by you and some are shared between you and your employee. Self-employed people pay both sharesThe maximum amount of work income subject to the Social Security tax is currently 147000 a number that will be adjusted for wage increases in 2023.

Streamline onboarding benefits payroll PTO and more with our simple intuitive platform. Select FY 2023 from the drop-down box above the Search By City State or ZIP Code or Search by State map. Open Enrollment for 2023 begins on November 1 2022 and ends on January 15 2023.

First day you can file your 2023-2024 FAFSA use your 2021 tax information. The expenses you pay with an EIDL advance are also fully tax deductible for federal taxes. Paycheck Protection Program PPP The Paycheck Protection Program offers loans to small businesses to keep employees on payroll and cover certain other expenses during the coronavirus pandemic.

Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. When is Affordable Care Act Open Enrollment for 2022-2023. FY 2023 Per Diem Rates Now Available Please note.

There have been several major tax law changes as of tax year 2013 including several that are the result of new Obamacare-related taxes. If your EOD falls between January 1 and June 30 you will receive your increment in January 2023. Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS.

The FY 2023 rates are NOT the default rates until October 1 2022. Ensures compliance with all local state federal and territorial tax and wage requirements. Annual changes to the federal health insurance marketplace coupled with Affordable.

In as little as 15 minutes significantly reducing processing time and costs. Please note this calculator is for the 2022 tax year which is due in April 17 2023. Complete all personnel and payroll related paperwork.

Last day you can work if you. You must follow these instructions to view the FY 2023 rates. The purpose of the 21st CCLC program is to provide federal funds to establish or expand community learning centers that.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Missouri local counties cities and special taxation districts. Product Services. The Federal Work-Study FWS Program is a federally subsidized employment program which provides part-time work opportunities for undergraduate and graduate students.

Pin On Ttcu News

When Are Federal Payroll Taxes Due Deadlines Form Types More

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

How To Pay Payroll Taxes A Step By Step Guide

2

President S Budget Proposes 4 6 2023 Federal Pay Raise Fedsmith Com

Pin On Information

2022 Federal State Payroll Tax Rates For Employers

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

2022 Federal Payroll Tax Rates Abacus Payroll

General Schedule Gs Base Pay Scale For 2022

2022 Federal State Payroll Tax Rates For Employers

Pay Scale Revised In Budget 2022 23 Chart Grade 1 To 21 Bise World Pakistani Education Entertainment Salary Increase Math Tutorials Salary

When Are Federal Payroll Taxes Due Deadlines Form Types More